- Competition increases in the mid-category of the used car market with more cars chasing the same buyers

- Fleet mileages plummet while prices increase

- Ex-rental cars’ age and mileage increase to compete with ex-fleet stock

- Younger dealer part exchanges begin to compete with ex-fleet stock

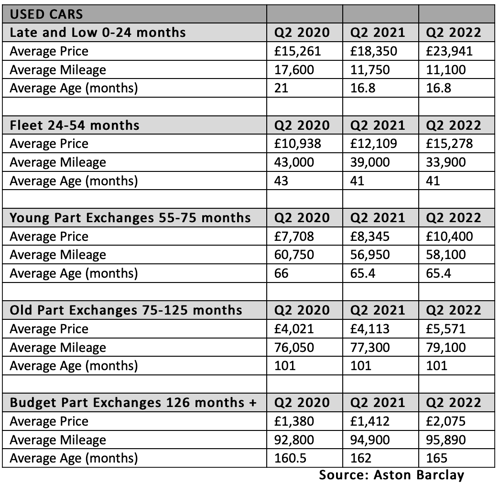

New research by Aston Barclay tracks the impact the Covid pandemic and global semiconductor challenges have had on the structure of the wholesale used car industry.

It analysed the average age, mileage and price of ex-fleet, daily rental and dealer part exchange used cars sold at auction between Q2 2020, after the pandemic first began, to Q2 2022. And it’s clear the impact of used stock shortages caused by new car sales compromised by the global semiconductor issue is threatening to permanently change the wholesale used car landscape.

Company car drivers travel fewer miles

As hybrid working becomes more commonplace company motorists are travelling fewer miles according to the Aston Barclay data with annual fleet mileages falling by -21.1% (9,100 miles), from 43,000 in 2020 to 33,900 in 2022. But, despite one-third of all lease contracts being currently extended due to new car supply problems the average age of ex-fleet cars has remained at 41 months over the past two years.

Prices however have increased by 39.6% (£4,340) from £10,938 in Q2 2020 to £15,278 in Q2 2022, close to the average prices of ex-rental used cars prior to the pandemic.

Late and low/ex-rental used cars

In August 2022 Aston Barclay sold its first post-pandemic ex-rental cars which averaged four years and 62,600 miles. That compares with the pre-pandemic average of around 18 months/20,000 miles. Generally, rental companies have been buying rather than selling used cars since the beginning of the pandemic to top up their fleets and this trend will remain as they struggle to source new cars.

The late and low sub-24-month sector profile which has historically been fed by rental suppliers and car dealers has also changed dramatically from an average of 21 months and 17,600 miles in Q2 2020 to 16.8 months and 11,100 miles in Q2 2022. The acute supply shortage has forced prices up by a massive £8,680 (56.8%) from £15,261 to £23,941 during that period with only a few unwanted dealer demonstrators and part exchanges trickling into auction.

Dealer part exchanges

Dealers have held onto most of their part exchanges since new car supplies have been compromised, particularly at the younger end of the market between 55 and 75 months. Those used cars reaching auction have remained at between 65-66 months in age, but mileage has fallen by -4.3% (2,650 miles) to 58,100 miles in Q2 2022 reflecting a restriction in driver journeys during the pandemic and due to hybrid working practices.

Prices in this sector have also risen dramatically by 34.9% (£2,692) from £7,708 to £10,400 in Q2 2022, due to a shortage of stock which is equivalent to the price of an average pre-Covid fleet car.

Open an account with Aston Barclay

Meanwhile, at the older age end of the part exchange market, prices have risen in the Budget sector to record levels which includes used cars of 126 months and older. Prices rose by 50.3% from £1,380 to £2,075 (£695) between Q2 2020 and Q2 2022 reinforcing the scarcity and demand for used cars at this end of the market. The price increase was despite the average age rising from 160.5 to 165 months and mileage increasing by 3,090 to 95,890 miles.

“The data shows that in a relatively short space of time that many of the used car sectors have changed dramatically, particularly at the late and low and budget ends of the market. Ex-rental used cars are now competing with ex-fleet cars at auction while the younger part exchanges have also increased closer to pre-pandemic fleet sector prices,” explained Mark Hankey, Aston Barclay’s Chief Revenue Officer.

“The data shows that in a relatively short space of time that many of the used car sectors have changed dramatically, particularly at the late and low and budget ends of the market. Ex-rental used cars are now competing with ex-fleet cars at auction while the younger part exchanges have also increased closer to pre-pandemic fleet sector prices,” explained Mark Hankey, Aston Barclay’s Chief Revenue Officer.

“It’s a lot to take in but basically competition has increased in the mid-sector of the used market. All those cars are now chasing the same buyers,” he added.